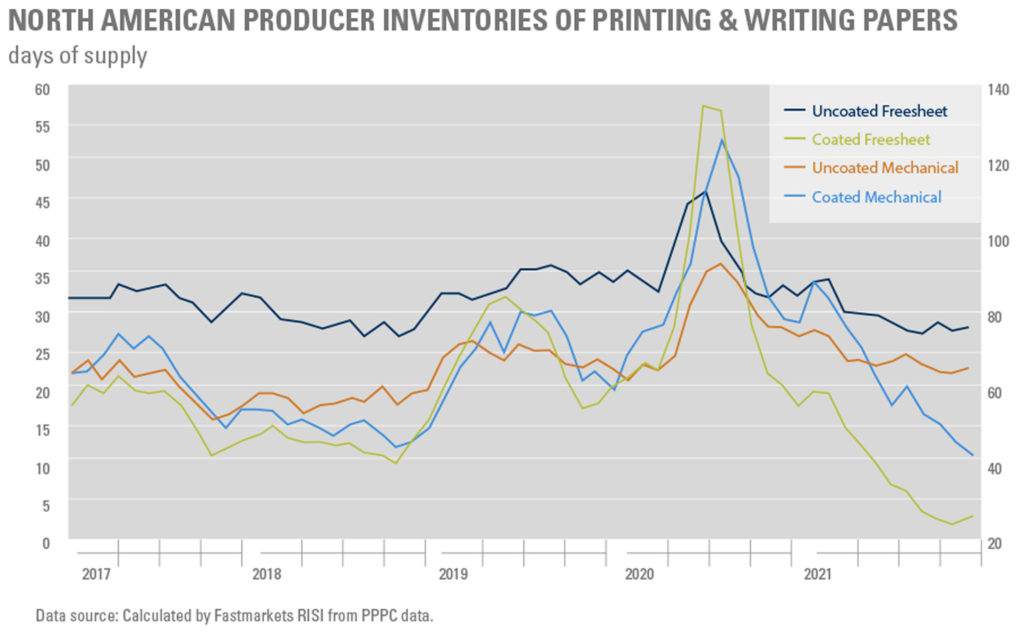

The paper market continues its rough ride into 2022 as supply and demand are still out of balance. Paper availability has shrunk, prices have continued to rise, options of available stocks have been reduced, and the delivery of paper remains inconsistent. Pent up demand from the high point of the initial COVID outbreak has been unleashed, as marketers looked in Q4 (and continue to look) to rev up campaigns for their clients.

Mills are running at between 94-100% capacity, making it impossible for them to meet the raging demands of the market. Operating rates are expected to remain at 92% or higher through all of 2022. Making matters worse, there is a lack of imported paper available to offset the undersupply of domestic paper.

Mill closures, shutdowns for maintenance, scaled back operations, transitions to the production of containerboard, cybercrime, and a fatal accident at the Domtar mill in Windsor, Quebec (which saw the mill, which can produce 1.2 billion lbs. annually, experience downtime for a month) have also contributed to the upheaval in the paper market. There is not yet a clear end in sight.

Paper Mill Shutdowns Cut Hard into Supply Right Now and for the Future

Resolute’s Calhoun mill in Tennessee was shut down in Q4, effectively removing 330 million lbs. of uncoated freesheet and high-brite uncoated groundwood products from the market. This closure came right on the heels of the closure of the Wisconsin Rapids mill, which affected not only the paper industry, but the state’s pulp and forestry industries as well.

BillerudKorsnäs, a European packaging producer, entered into a merger agreement with Verso Corporation pursuant to which it plans to convert Verso’s Escanaba mill to virgin boxboard. The first mill line planned to convert will be in 2025 meaning there will not be an immediate impact on the supply of direct mail papers.

The Evergreen Pactiv Pine Bluff mill was shuttered in October, reducing the supply of coated mechanical paper, often used in publication print. This should not impact the coated freesheet market, and no other mill conversions or closures are expected to take place in 2022.

Additional Factors are Restricting Marketers’ Access to PaPER

Paper mill maintenance and machine downtime in Q4 exacerbated the supply issues in the paper market, moreso than in normal periods. Typically, mills draw from inventory while equipment is idle, but with little to no inventory left, this simply wasn’t an option in 2021.

Coated and uncoated freesheet prices rose an average of 20-25% in 2021. RISI expects at least two additional price increases in 2022. Verso recently announced an uncoated freesheet increase of up to 8%, starting with delivery dates of 2/1/22. It is expected that other suppliers will follow suit.

Delivery issues caused by the lack of labor and freight carriers plague the paper market as well. Paper mills tend to be in remote areas of the country and with the high demand for and short supply of truckers, delivery times have been significantly delayed. This further curtails marketers’ access to paper.

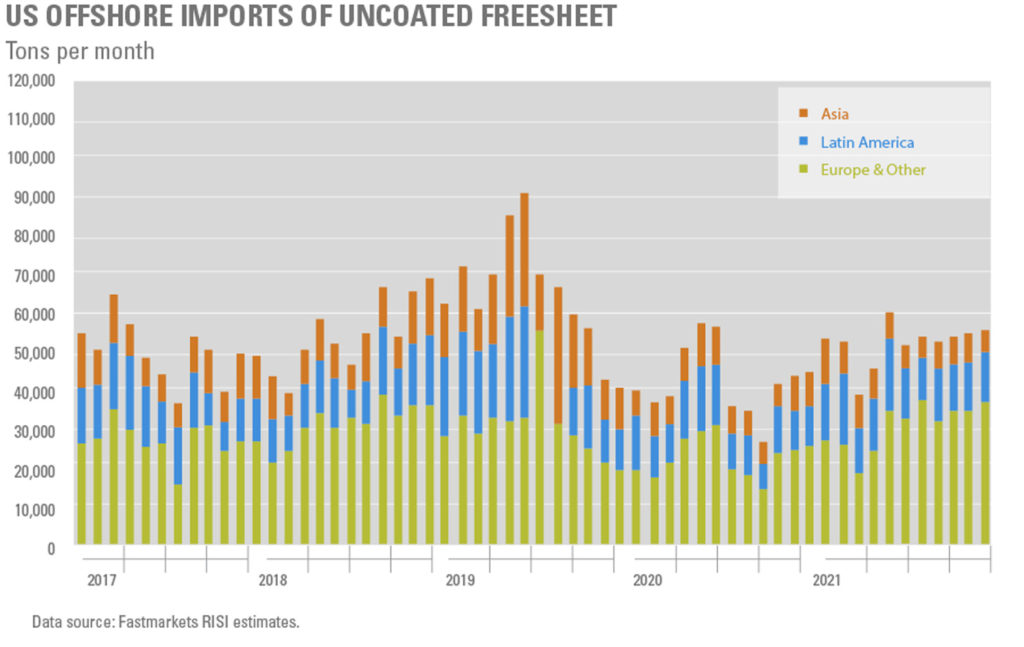

Imports Remain Challenging

Typically, the U.S. imports 30% of its coated freesheet paper from the Asian and European markets. Logistical challenges and supply chain issues have limited papers coming from these markets, particularly the Asian market. The cost for shipping a container of paper overseas has increased 1000% over the last twelve months due to a container shortage and an increase in port of entry costs. Even if containers are available, the costs of the containers have made it uneconomical to import significant quantities of paper.

Additionally, North American pulp prices rose 40% over the previous year. China, a very large global supplier of pulp, recently enacted an environmental initiative that closed 279 pulp and paper mills as well as capped pulp capacity. Further, China banned the use of wastepaper for recycling, both of which are contributing factors in the inflation of pulp prices on a global level. Nine Dragons Paper wrote in a price increase letter that this price adjustment was due to the continuous sharp increase in the prices of raw materials such as wastepaper, coal, and chemicals, resulting in soaring papermaking costs.

Paper Trends and Updates

- ND Paper announced price increases up to 6% for new and existing orders of coated stocks delivered on or after February 15th. We expect other coated paper suppliers to follow suit.

- Demand has outpaced supply in caliper grades for direct mail at a higher level than demand in other areas, this would include common sheets such as 7pt and 9pt coated stocks. These are often used for self-mailer and postcard applications.

- Lighter weight stocks, 100# text and below, have been easier to get through certain mills than heavier weights.

- The Solid Bleached Sulfate (SBS) market is extremely tight with available supply. WestRock and Clearwater have stopped producing 8 and 10pt coated sheets until further notice as they are focused on production of heavier weights, 15pt and higher.

- Veritiv will no longer sell sheets from Verso but will still supply graphic web (rolls) paper. Anthem and Sterling, which are the common sheets produced by Verso, will no longer be available through Veritiv.

- A strike started January 1st at the UPM mill in Finland. The strike will last until January 22nd, unless an agreement is reached first. Veritiv’s private label uncoated paper is produced at this UPM mill; this could cause some disruption and is a situation we will monitor as orders from UPM in Finland could be postponed.

Key Take-Aways

All is not lost. Supply and demand will eventually equal out and mills will begin to build inventory again, but certainly not at pre-pandemic levels. It is unclear whether or to what extent this re-balancing will occur in 2022. The first sign of a market swing will be when allocations are not fully being used and paper once again becomes freely available for purchase.

SPC is here for you in this challenging market. We understand that careful planning ahead on a project and the willingness to be flexible and nimble in exploring options, not just with respect to the type and weight of paper used, but also with respect to the design and layout of the project can enhance the likelihood of obtaining the desired paper in a timely manner.

Contact Ryan LeFebvre at ryanl@specialtyprintcomm.com for assistance in making your DM programs a success.