Like many areas of the economy, the global struggle and heavy turbulence due to tariffs have also destabilized the international paper market. Nobody knows how this will play out as the year unfolds, but at the moment, we’ve been able to avoid any tariff-related price increases as most of SPC’s paper is locally sourced and unaffected by the tariffs. Our bigger concern is how these tariffs impact the broader economy and to what extent brands shift marketing spend and other growth investments to accommodate tariff requirements. We continue to look for ways to build cost-efficiency into our process to help offset these dynamics.

On April 2nd, President Donald Trump announced the tariffs that would range from 20-37% depending on the exporter. On April 9th, he placed a 90-day hold on the 20% tariff and has instead imposed a 10% tariff across the board. After July 2nd, there is uncertainty about what will happen. Timing with the tariffs is important. Whatever tariff is in effect at the time the product hits the port and clears customs is what will be charged.

What Paper Products are Affected by Tariffs?

The US-Mexico-Canada-Agreement (USMCA) allows for most paper products to be exempted from tariffs. Paper is not currently listed as a product included in the Trump administration’s investigation into the purported national security threat posed by imports of lumber from Canada. However, converted paper products (like envelopes, mailers, and books) are included in that investigation, which could lead to potential tariffs or restrictions in the future.

Currently, businesses are navigating the impact of tariffs with varying approaches. Importers are passing the tariff costs onto customers. European suppliers have confirmed they will honor the original prices for “floating” orders placed before the tariffs were imposed. However, after that, they will implement a 10% increase on new orders for this 90-day hold period. South Korean suppliers have agreed to honor products that have already been ordered, but they are undecided about future orders and have decided to put those on hold for now until they get a clear idea of the outcome of the negotiations.

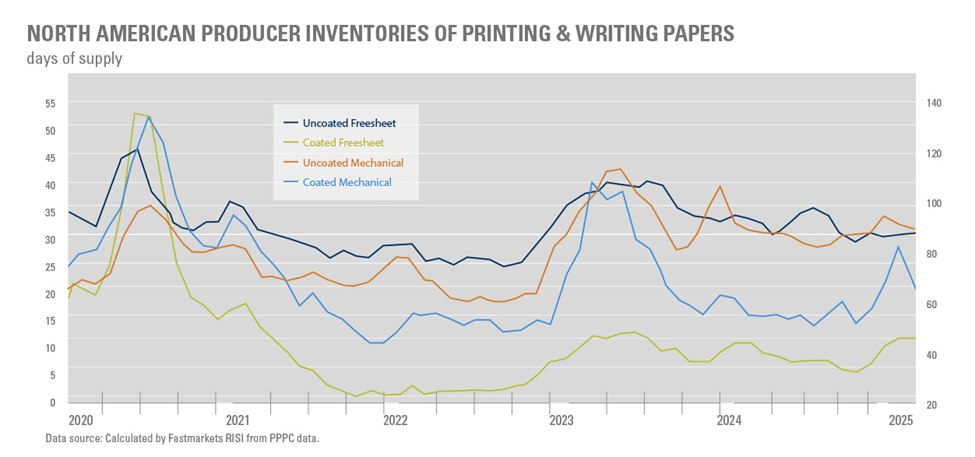

Mill Inventory Levels

Domestic mills have a mixed reaction to the tariff news. Their focus lies more on exports. The expectation is that U.S. mills won’t need to reduce their exports, as operating rates are not expected to tighten significantly.

Due to the USPS Add-On Incentive, there has been a significant increase in the use of sustainable paper, such as SFI and FSC. We do not anticipate any challenges in fulfilling orders from our clients; however, FSC has more limited available credits compared to SFI.

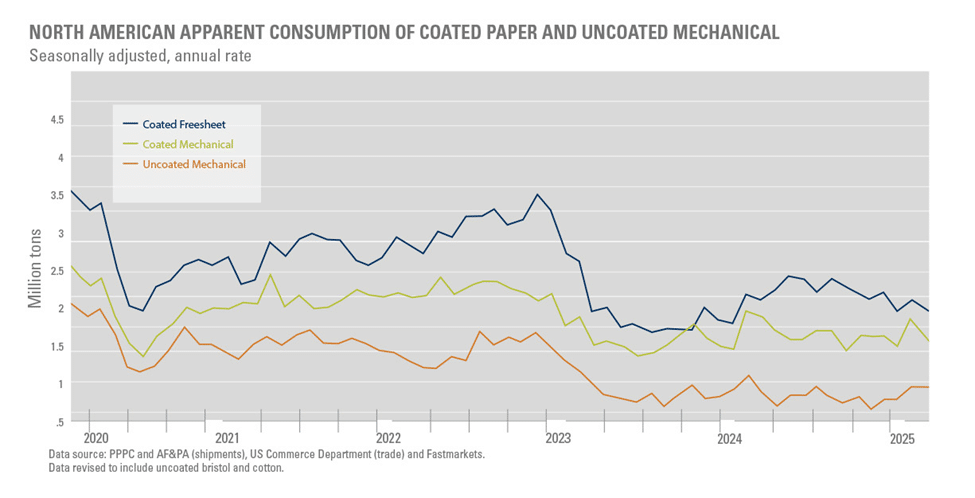

The updated forecast indicates that in 2025, the demand for printing and writing paper is anticipated to decline by 8.3%. The hardest hit will be coated papers, of which offshore supplies accounted for 35-38% of US demand in 2024.

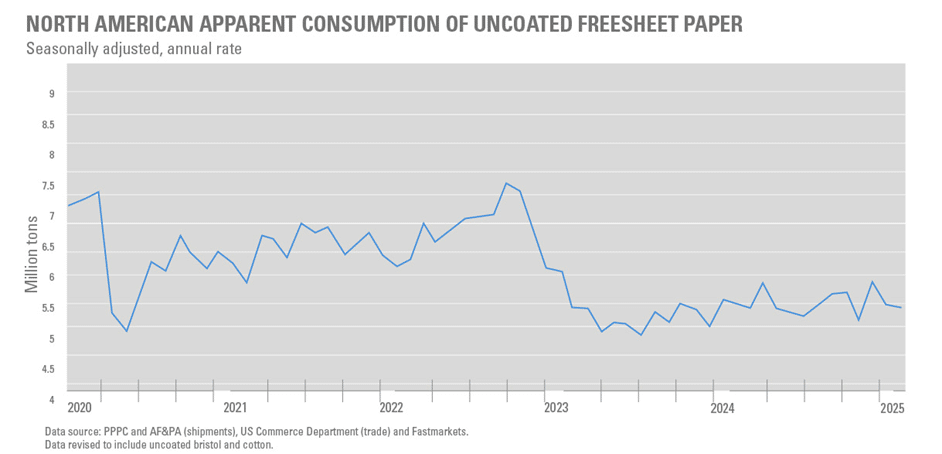

Uncoated Freesheet

Uncoated freesheet was experiencing reasonable demand stability; however, this will change in Q2 2025 due to tariffs. The baseline forecast predicts that uncoated freesheet demand will start to stabilize and catch up to long-term trends by 2026-27. However, it’s expected to remain 8-9% lower than pre-pandemic levels by 2027. Recovery is slower than hoped, but could potentially improve more than expected. Operating rates are expected to range between 80% to 90% in 2025, a slight downgrade from what was forecasted before the tariff announcements.

The Uncoated Freesheet market is perhaps a bit looser than folks would like to think. The mills have built up inventories, but rather than hold onto them themselves, they often sell them into the secondary market. While the secondary market can be beneficial for ad hoc projects, there are inherent risks involved since the products are sold as-is.

Pixelle Specialty Solutions announced in mid-April that it would close its mill in Chillicothe, OH, due to unsustainable financial challenges. However, just a week later, the company announced a pause in the closure until the end of the year, allowing time to “evaluate what’s possible.”

Coated Freesheet

As we mentioned in our Q4 Paper Market Unfolded, Sappi’s Somerset converted its coated freesheet machine to packaging in January, removing 470 million pounds of coated freesheet. This conversion is discontinuing lightweight coated, which went as low as 40 lb. text, predominantly used for the catalog and magazine industries. This paper machine will now primarily be focused on the graphic side of the industry, 60 lb. text up through cover weights. We expect the market’s operating rates to climb just over 90% due to the combination of the decline in imports and the conversion of PM2 at Sappi’s Somerset mill.

Sappi is currently experiencing tight allocation and implementing some restrictions due to this conversion. To alleviate these issues, they are working to increase manufacturing at their other mill in Cloquet. Sappi’s allocation is on their text weights from both mills (on 60 lb. text – 100 lb text weights) – pushing lead times out to 5 to 7 weeks.

The restrictions from Sappi are also putting pressure on the other two domestic mills, Billerud and ND Paper (Nine Dragons). That being said, overall inventory levels are at a responsible amount and mills are not overstocking. Currently, lead times for coated paper remain manageable at 4 to 5 weeks, with earlier deliveries possible.

UPM at Blandin is currently on allocation for coated #5 and #4, which is expected to continue until June. However, changes in the tariff situation could impact this timeline. While these papers are not typical for direct mail, they play a role in the broader paper market.

Based on the current market conditions, we do not expect any further price increases, depending on global tariffs and the responses of paper companies.

The coated paper market demand is expected to decline by 13% due to several factors, including disruptions in imports and a weak economic outlook.

As mentioned above, imports play a big role in the coated paper world by accounting for about 35% of coated freesheet demand in 2024. Due to the current tariff situation, the import share is expected to fall below 30% in 2025.

Key Thoughts

As we approach Q2, a significant factor to consider is how tariff policies will impact the general economy, which in turn affects our paper market. Tariffs threaten the strong recovery the paper market has been pursuing over the past couple of years. Given the potential for tariffs and increases in postal rates, now is an ideal time to take advantage of USPS promotions. Read SPC’s latest blog about the new AI Incentive, which may be the easiest way to receive 5% discount on your postage.

SPC will keep you informed and assist you in navigating the evolving landscape of the paper industry. As always, we recommend planning ahead as it allows for the most opportunity to explore all your paper options.

We will soon announce the date for our next Paper Market Roundtable Zoom session, where SPC will host a Q&A with experts from both the mill and merchant sides of the industry.