The SPC Q2 Paper Market Update started out with this sentence, “The paper market remains in crisis causing ripple effects across the U.S. Economy.” Current market conditions are essentially the same as they were in Q2. Paper experts have predicted a more normalized market returning as early as middle of 2022 while SPC is fearful it may not be level until 2023. As is the case with all markets, the paper market is influenced by supply and demand. While the pandemic initially made marketers averse to spending, that trend is beginning to reverse itself as stimulus money enters the economy. Marketers continue to ramp their campaigns back up with increasing demand for print. Unfortunately, no one can guarantee paper will be available for marketing projects no matter how far out a team has planned, and currently paper orders and deliveries are as far out as the new year.

Paper availability is still at a premium as mills have historically low inventories and very high operating rates and demand is unyielding. The pandemic sped up the shut-down of mill lines. Many other mill lines were converted to production of packaging and board. Compounding the problems are labor shortages, high pulp and other input costs, increased transportation costs, and global logistics issues. We are starting the traditionally busy 4th quarter holiday season with low availability and raised pricing.

There are three main factors that can change the current market conditions. These are:

1. Domestic paper supply increases

Declining capacity continues to plague the printing industry and paper suppliers will not put a hold on paper for an order, as in the past. Stock availability is contingent on what the mills produce, not on what the consumer is seeking. Paper manufacturing has shifted to what is most popular or most profitable. Mills are focusing on producing more profitable papers such as heavier 80# and 100# coated texts and cover grades and decreasing production of the lighter coated freesheet basis weights 60# and 70# texts. We have also continued to see mills converting their lines from printing grade paper to brown board used for items such as shipping boxes.

Adding to the supply challenges are the prices of coated stock which are creeping up to levels not seen since 2008. Paper mills have shown a continued commitment to shutting down mill lines when mill operating rates do not hit an 85 – 90%+ rate. There is no reason to believe a non-operating domestic line will start making coated freesheet grades in this current climate.

Also, non-integrated mills (mills who do not produce their own pulp for the paper making process) are in long term jeopardy as they struggle with the prices of pulp, which are up 40% this year.

- Currently, the largest four domestic producers of paper account for 75% of North American capacity. Lack of competition is a negative factor for SPC and our customers.

- Independent niche players such as Neenah and Mohawk are continuing to operate in the text and cover markets but can’t produce enough paper to meet the demand.

- The closing of the Evergreen Packaging Pine Bluff mill removes 183,000 tons of coated groundwood paper from the market. Some but not all of this loss has been offset by the Port Alberni mill reinstating its production of coated mechanical grades. These are not typical sheets on which SPC prints as they are mostly used in the publication market.

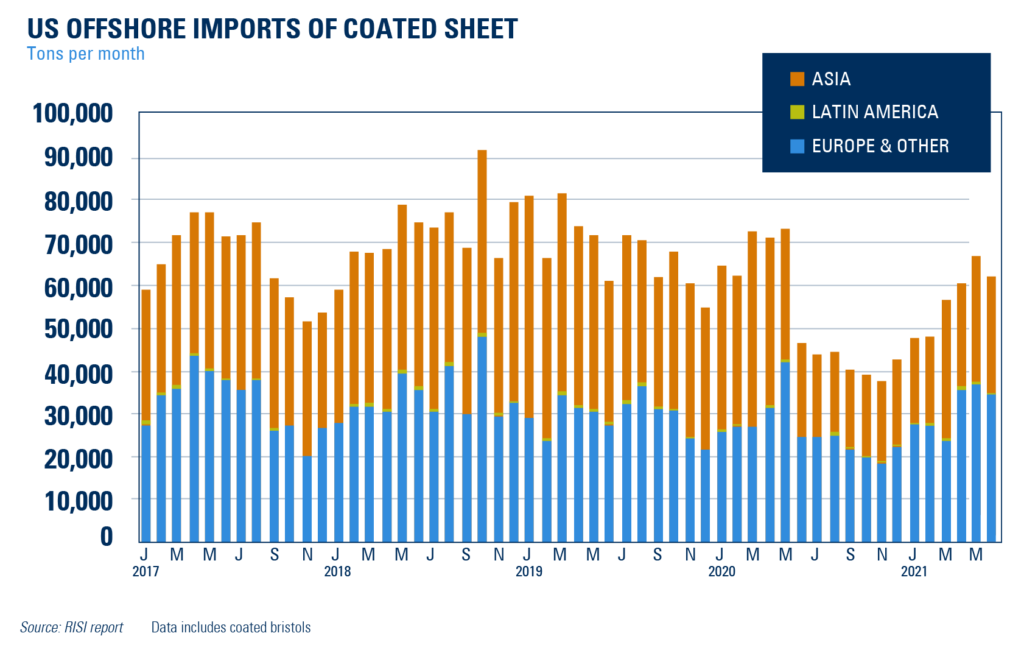

2. International paper supply increases

The US market would benefit from additional international paper arriving. SPC expects imported coated stocks will be near an all-time high for the remainder of 2021. The restarting of international economies coming out of the pandemic is creating more global demand, not just domestic demand. But it is unlikely a large enough global supply will be available to meet US market demand in the short term. This is in no small part due to the fact that global logistics continue to plague paper delivery and exporters are feeling the pinch. Container shortages, record high freight charges, and delays in ports contribute to the shortages and price increases in paper. The price of a shipping container is up 344% from this same time last year.

3. Domestic print demand decreases

Print is considered to be in continued secular decline. Coated freesheet capacity is down 1,835,000 tons since 2017 which has caused the ripple effect of mill closures. Coated freesheet demand is expected to rise 4% with groundwood demand forecasted to decrease by 5%. While decreases in demand may ease paper increases, it is also likely to result in eventual further equipment shutdowns. Manufacturers are already suffering from shutdowns during the pandemic. Mills were not prepared for the resurgence of demand. With the lack of inventories to meet demands, some marketers are forced to cancel programs completely or divert advertising dollars from print to other media channels. This causes a long-term threat that could result in eventual decreased demand.

Q2 “Ray of Hope” Updates

In the SPC Q2 Paper Market Update, we had two reasons for hope: the opening of Domtar’s Ashdown, Arkansas mill and the potential purchase of Verso by Atlas Holdings.

The Ashdown mill is set to start paper production in January of 2022, which, on its face, appears to be good news. However, it is our understanding that this mill is being brought back online to produce cut sheet copy paper for a single client who will resell the paper direct to consumers. Additionally, this client’s current contract is with a different mill and once that contract expires that mill line may be converted to production of brown board stock, which will remove more paper from the market.

It was announced on September 21st that Atlas Holding’s cash offer was “insufficient” and Verso “would only consider a potential transaction if Atlas meaningfully increased its offer.” We believe negotiations will still continue but are uncertain if the parties will get a deal done. In any event, industry experts don’t expect an acquisition by Atlas Holdings of Verso to result in the re-opening of the Wisconsin Rapids mill, as we had previously hoped.

Q/A News + Notes How far out should a marketer plan?

The more time marketers allow for planning, the higher the likelihood they will be able to get paper. Although certain papers could be available in days or weeks, many large or custom orders can take significantly longer. Some mills may not even accept large or custom orders at this point. Set yourself up for success by planning in advance.

- A few uncoated mills are on allocation. Others are quoting their next available ship date. On average, lead times are about 8 – 10 weeks for uncoated sheets.

- All coated sheets are on allocation. Lead times are typically 8 – 12 weeks if an order is accepted based upon the specific sheet, tonnage needed, and timeframe. Just because an order is put in months in advance does not mean the order will be guaranteed, but the extra time helps to improve chances.

What does “allocation” mean and how does it work in the current market conditions?

Allocation is a tool mills use to try and gain control of printers’ orders when demand for paper exceeds supply. Most mills base allocation percentages on a printer’s past purchases. They normally allocate to a particular printer a percentage of what that printer has purchased in the past. For example, if SPC purchased 2,000,000 lbs. a month, SPC may receive an allocation of 60-70% of that number.

Mills also consider the basis weights and the grades of paper a printer has purchased in the past when determining what that printer’s allocation will be. If a printer purchased a lot of caliper grades, most if not all of the allocations would be for those grades. If a printer had not made significant purchases of 60# text in the past, it would be harder for that printer to get an allocation of that text.

A printer’s allocation is also impacted by how far behind the mill is in production, i.e., its operating rate. This number can change from week to week. Allocation periods are usually two months into the future. Placing orders can be difficult, especially when you don’t know what your paper requirements are that far out. We are placing orders now for December allocation, with deliveries scheduled for mid-late December.

Companies who are just breaking into direct mail marketing or are attempting to increase their print spend will have a difficult time obtaining paper. SPC has relationships with secondary merchants that might have available paper. For every opportunity, we are looking at all options to meet our customers’ needs.

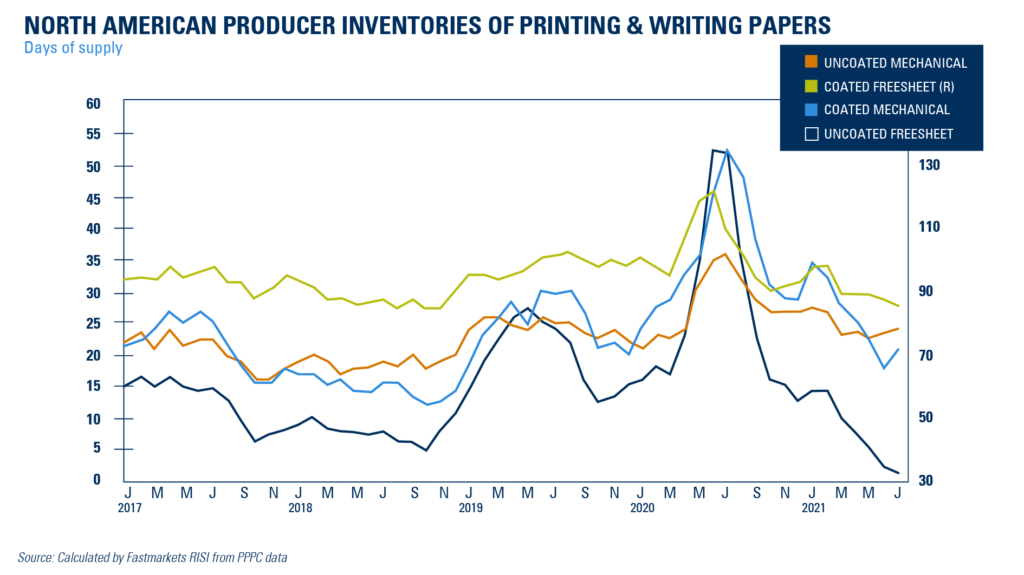

How are current inventory levels?

North American mills’ inventories of coated freesheet are at rock bottom levels after peaking in 2020. We don’t foresee inventory levels returning to pre-pandemic levels for a long time. Mills have been running at over 100% operating rates most of 2021, which means very little paper is in inventory. With coated freesheet operating rates forecasted at 96% in 2022, it will be a slow return to the inventory levels to which we are accustomed.

Domestic mills have decreased allocations as they are working to build inventory levels to allow paper to be more readily available months down the road. By allowing inventory to increase from current levels, mills will have more machine flexibility, which hopefully will result in more accurate delivery dates and shorter lead times

What can marketers expect to happen with paper prices in the next year?

The industry has experienced coated paper price increases in July, August, and September. Although we do not believe there will be another increase until Q1 of 2022, we would not be shocked if one comes prior to end of the year. With the lack of paper supply, marketers have no choice but to pay the increased price.

SPC believes heavier basis weight coated freesheet prices will remain mostly stable at or slightly above current levels with the occasional price increase as influenced by input costs combined with supply and demand. Nine Dragons announced a price increase on September 30th for lightweight coated sheet that will result in a 2-3% increase. With the closing of the Evergreen mill, a coated groundwood price increase could be announced soon as well. Several mills have announced an uncoated paper increase on September 30th for paper starting to ship in the middle of October. The increases are in the range of an additional 6 – 9% depending on the mill. We expect all other mills to follow suit and announce an increase in the coming week.

Is ordered paper being delivered on schedule?

Traditionally, the on-time delivery rate of scheduled paper has been extremely high. Over the past few months, however, we have seen the on-time delivery rate slip. Some paper is being delivered days or even weeks late. SPC is keeping its customers apprised of these updates in real time in the event projects might be affected.

Why is it taking so much longer to get an estimate back?

Estimates are taking longer as each quote opportunity must be confirmed for paper availability instead of relying on stock paper or quick turn paper. Plan for a normal estimate request to be returned in 2 – 3 days as we make sure we can get stock and produce your project in your requested time frame.

Final Thoughts

At some point in the future, the paper market will turn around and supply and demand will stabilize. Paper experts are predicting this will happen in the middle of 2022. SPC believes the current market conditions will last until 2023.

We advise our customers to plan ahead and communicate their needs as far in advance as possible. Customers should also be prepared to make a quick decision to confirm a stock order and also be ready to be flexible with stock options for non-programmatic work that is not locked into an allocation. SPC is here to be your partner in this challenging market and ensure your print programs are successful.

Key Terms:

Coated Free Sheet: Mechanical wood pulp-free coated with clay or a similar substance. A synonym of “freesheet” is “wood-free.”

Uncoated Free Sheet: Paper that contains no more than 10% mechanical (wood) pulp, often none. Commonly called offset or uncoated.

Coated Groundwood Paper: Mechanical papers other than newsprint, made with substantial proportions (30 — 75% groundwood pulp) of mechanical (wood) pulp, coated with clay or a similar substance.

RISI: Resource Information Systems Inc.; Fastmarkets RISI is the leading price reporting, analytics and events organization for the global forest products, metals, and industrial minerals markets.

Operating Rates: Operating rates are the capacity, or amount of time a machine is used, at which mills are engaged in production, i.e., running at 95% capacity or operating rate.