Executive Summary

The paper market remains in crisis causing ripple effects across the U.S. economy. Marketers have been forced to scramble as they identify alternative paper choices, spend more for paper orders, and delay campaigns—just as brands are working through their own post-pandemic recovery. We don’t see a significant rebound toward normalization until Q2 of 2022. It is critical to plan campaigns and strategize with SPC well in advance of previous traditional paper order timeframes to give your campaigns the best opportunity for success in procuring stock. Plan your campaign months ahead instead of weeks ahead. Work with SPC to understand your options and craft the smartest possible paper strategy.

Domestic Paper

- Cost inflation will persist for most of 2021

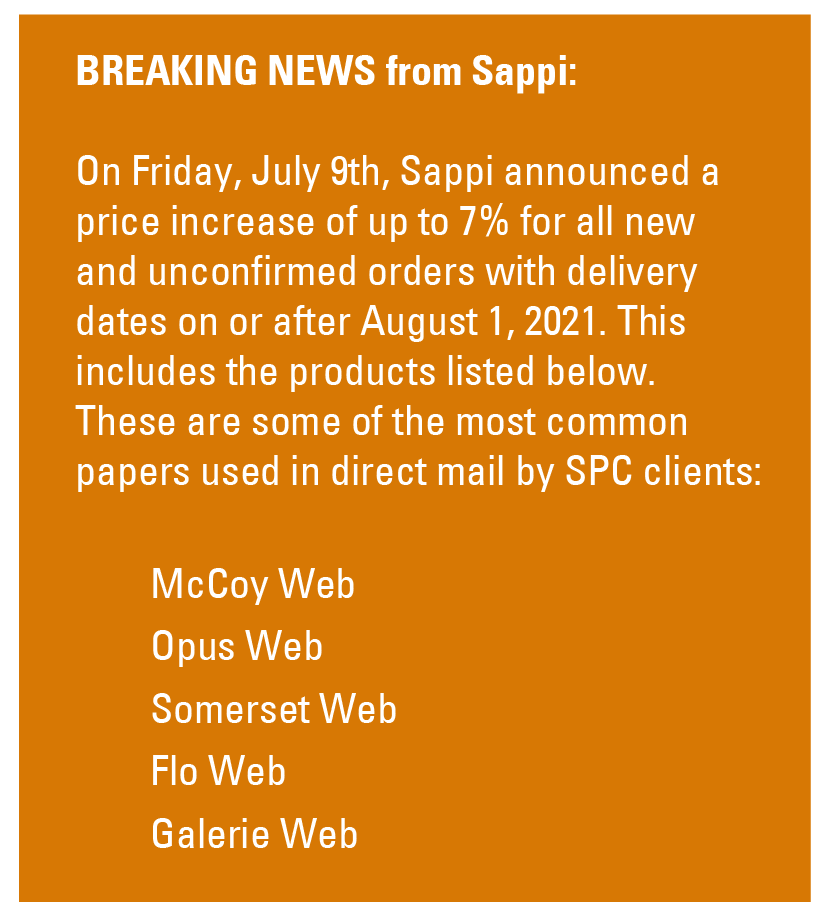

- Prices have continued to increase with price increase announcements from Sappi and Verso over the past 2 weeks. We expect these will be the last increases that affect SPC customers in 2021.

- Don’t expect recovery of mill inventories this year unless demand significantly loosens. Easing of demand is not expected as the busiest direct mail season is ahead, centered around the traditionally busy holiday season.

Import Paper

- Imports will continue to stay at decreased levels until the stress on the global supply chain is relieved.

Timing of Relief

- Forecasting early 2022 before opening of the supply chain. The global paper market can recover quickly if transportation issues can be overcome.

Domestic Manufacturers at Historic Low Inventories

Mill inventories are depleted—any excess inventory left in the supply chain is now gone. The coated paper inventory is at an all-time low of 46%. Only a year ago, mill inventories were at 112% capacity. Until Verso’s Luke and Wisconsin Rapids mills were shuttered, the market had seen excess paper inventory which became part of the start of the challenges we face today. From July 2020 to April 2021, there was a 66% drop in inventory supply—about 200,000 tons of inventory gone which equates to 400 million lbs or 10 thousand truckloads of paper. With mill lines being shut down, this inventory cannot be replenished. Operating rates remain over 100% and have been this way for the past 6 months. Any production issues that cause additional down time will trigger major delays in the supply chain.

SPC continues to block out time with partners to help mitigate delays. As clients commit to new campaigns, our paper experts are placing orders with suppliers immediately. Even an order placed immediately doesn’t guarantee paper will be available. The paper mills have presented a big challenge. Sappi will not allocate SPC’s September paper tonnage until July 19th. This may mean marketers who have orders entered for campaigns in September may not get paper. Mills not confirming their run schedules affects the current market demand. This makes establishing paper order dates a challenge.

Transportation Challenges Continue in the Global Supply Chain

What’s causing these challenges?

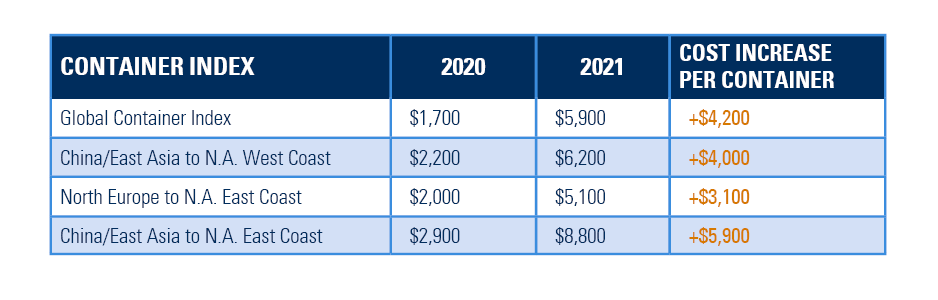

- A huge shift in consumer spending through the pandemic resulted in an increase in consumer products shipped, which in turn caused a surge in demand for containers.

- Containers are generally not in ideal locations to be readily available for shipping from paper mills.

- The increased demand and COVID-19 safety protocols at each port result in longer shipping times.

- 15% of global container flow came to a halt when the Ever Given ship was stuck in the Suez Canal in Egypt, in March. This has caused a ripple effect on global shippers over the past several months.

- Retailers are ordering product ahead of time for expected busy fall and holiday seasons. As a result of products shipping earlier than normal, less containers are available for paper to be shipped.

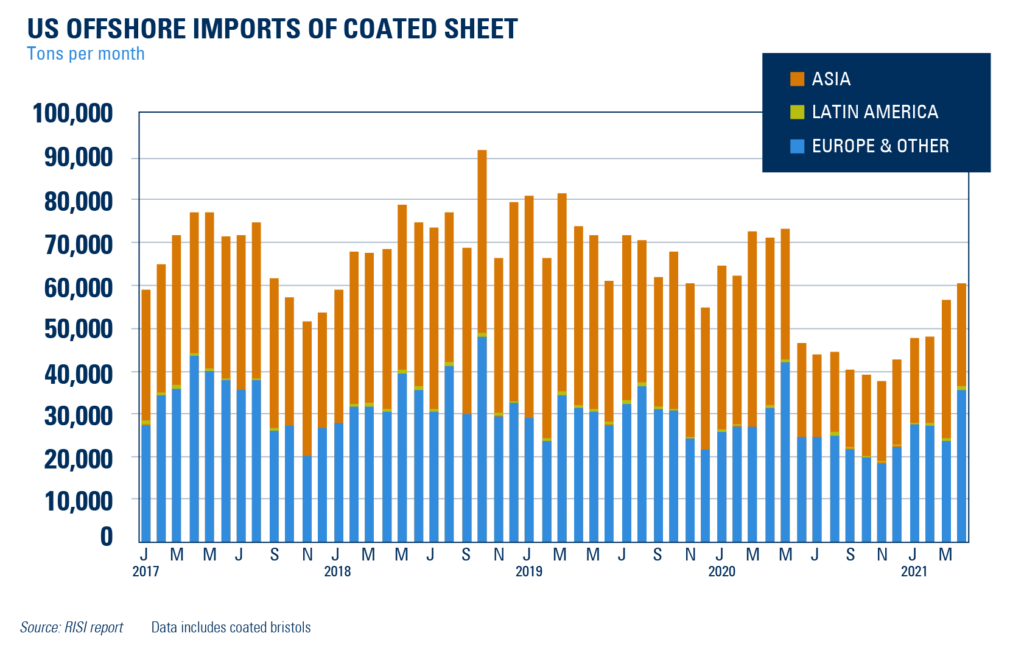

Paper Imports from SE Asia at Record Low

In 2019, 35% of the supply of paper in the U.S. came from Southeast Asia imports. In Q1 of 2021, this dropped to 26%. This drop in supply from Asia pushed domestic suppliers to make up the difference. U.S. Mills have been pushed to their limits from mill closures, which in turn, have dramatically increased operating rates.

Shipping containers that make it to the U.S. are often held up at ports waiting to get on rail cars. Delays as much as weeks, and even months, have not been uncommon. These massive delays in the supply chain are felt all the way to the desks of marketers as they all struggle to hit their campaign dates.

Source: PPPC & Veritiv Print Analysis

When will it Recover?

The Southeast Asia imports are taking an extended pause. Suppliers that source large volumes of paper from Korea, such as Lindenmeyr Munroe, Spicers Paper, Athens, and Midland Paper, are getting squeezed without reasonable options. The supply chain isn’t expected to be normalized until the middle of 2022.

Source: Veritiv’s Insights on the State of the Paper Industry, by Jeff Pfister.

High-Level Overview by Product

- Coated paper will continue to be in limited supply. However, cut-size is predicted to loosen up in availability in late Q3. This should help improve market conditions.

- Offset rolls are also expected to become more readily available by the end of 2021.

- Some mills have decided to start eliminating certain grades altogether or until early next year. Mills and suppliers continue to look for comparable alternatives to unavailable paper grades.

- In 2019, suppliers sold 3.3 million tons of coated paper. In 2020, demand for this paper shrunk by 700,000 tons. Demand is expected to shrink by an additional 900,000 tons in 2021. This explains why the WI Rapids and Luke mills are not re-opened. Paper suppliers believe, though demand is currently high, future demand will not be large enough to support the re-opening of mills as the operating rates need to be in the 87-95% range on average to be healthy.

- Because of inventory depletion, mill rates have been operating at 100%+. The operating rates have been increasing significantly, even compared to 2019, when operating rates were running at an average of 91.8%. In 2020, they dropped to 83.6% and 2021 is predicted to have an average of 94.9%.

- Imports for offset will help drive the recovery. April had the highest level of imports since the middle of 2019, accounting for 13% of North American demand. In 2021, imports are expected to account for around 10% of North American demand.

- Normalization in demand will eventually level out, but without the ability to add major capacity, this will most likely not occur until late in 2022.

Ray of Hope

- The potential purchase of Verso by Atlas Holdings presents an opportunity to increase supply to better match demand. The purchase would involve all assets, including the currently shuttered Wisconsin Rapids mill. If this occurs and Atlas chooses to reopen the Wisconsin Rapids mill, it would be great news for marketers.

- Additionally, on July 15th, Domtar will begin reopening a shuttered Ashdown, Arkansas mill machine. The mill is expected to resume full operation in January of 2022 and provide an additional 185,000 tons of uncoated paper capacity. This will result in nearly 9,250 additional truckloads of paper available to marketers.

Conclusion

It is crucial to coordinate with SPC so we can assist in building smart strategies with our mill and supplier partners well ahead of your upcoming campaign dates. Paper will continue to be extremely difficult to source and prices will continue to be volatile throughout 2021. It will likely take another 6+ months, but there is a faint light at the end of the tunnel as more countries are able to normalize in a post-pandemic global economy.

SPC is actively working with Verso to continue our formation of The National Paper Advisory Council. The Council will facilitate transparent, open communication between paper mills, paper sales organizations, printers, and industry thought leaders to better align common objectives in the availability, sale, and utilization of papers in manufacturing print.

Contact me to help your direct mail program succeed.

Ryan LeFebvre

Executive Vice President of Sales & Marketing