In Q3 2022, we saw a continuation of market conditions from the previous quarter. However, there are signs the imbalance in supply and demand is easing.

Our hope moving into Q4 is for the overall market to loosen up, at least in some of the more common paper grades. Market demand tends to ease after the holiday season, which will eventually be reflected in the supply and demand balance.

With allocations still in place, buyers have strategically added to their inventories whenever possible. Prior to the pandemic, mills and merchants used to carry vast inventory to meet quick turn demands. These days, mills are holding almost zero in inventory and merchant inventories are also extremely low. Printers have been forced to build up their inventories to make sure paper can be secured, especially for programmatic business or print projects that are planned four or more months in advance. This has created storage and financial challenges as paper is being billed oftentimes many months in advance of printing. Even with these challenges of limited paper supplies, overall printing volume has remained steady.

SPC has worked with our mill and merchant partners to continue growing our allocations, which is not a common story in the marketplace. We have been able to purchase more paper than pre-pandemic levels due to our strategic relationships, high purchasing power, and flexibility with mills on delivery.

In our Q2 2022 Paper Market Unfolded, we focused on the recent price increases for multiple grades of paper, the status of coated and uncoated, and the potential for a balanced market in 2023.

As predicted, we saw additional price increases in Q3 2022 due to still-rising input costs – pulp, labor, energy, chemicals, and freight. SPC recently sent out an alert sharing the announcement from Billerud and Sappi that domestic coated paper will increase by 8%. With Billerud and Sappi combining for over 85% of the domestic coated market share, we expect all others to follow suit.

Unfortunately, since this announcement, a domino effect has occurred. The industry, already hit with high costs for raw materials and transportation, now must react to the rise of energy costs. The entire global supply chain will soon feel the repercussions.

International Mills Update

Sappi, the leading European producer of coated graphic, packaging, and specialty paper, announced in September it has agreed to sell three European graphic paper mills to Aurelius Group, a pan-European multi-asset management company. The three are the Maastricht Mill in the Netherlands, Stockstadt Mill in Germany, and Kirkniemi Mill in Finland, all of which produce papers used in publications, graphic papers, and graphic boards. The advantage these mills have over others in Europe is they produce self-sustaining energy in the forms of electricity and steam, reducing dependence on external energy sources.

Italy’s Burgo Group has announced it will reduce production at three Mosaico specialty paper mills: Tolmezzo Mill, Toscoiano Mill, and Mignagoia Treviso Mill. Burgo will introduce temporary layoffs due to energy cost issues at these mills. It’s safe to assume Burgo prices will soon increase due to this action, resulting in an impact on European prices and inventory.

Tolmezzo Mill will slow its most energy-intensive operation, pulp production, sometime before October’s end. Instead of direct layoffs, the mill will implement work rotations. Tolmezzo produces approximately 40,000 tons of pulp per year. This mill has a capacity of some 172,000 tons/yr. of specialty paper on two PMs.

Toscolano Mill’s activities will halt from September 17th to September 26th resulting in labor layoffs. This mill has a capacity of around 124,000 tons/yr. on one PM.

Mignagoia, Treviso Mill will cease all activities from September 16th to September 25th. This mill has a capacity of around 62,000 tons/yr.

Domestic Mills Update

Billerud’s Quinnesec Mill took downtime in September for machine improvements. Billerud is working to balance efficiencies between their Quinnesec and Escanaba mills. Quinnisec will be running a test in late October with a goal to run coated paper up to 9pt thickness. The current max at this mill is 65# Cover (7pt or less). With caliper grades being the most difficult to obtain, the opportunity for more production of these heavier-coated stocks could provide increased availability to the marketplace.

Pixelle Specialty Solutions, the third largest uncoated freesheet producer in North America, announced that its mill in Jay, Maine will close in Q1 2023. Pixelle noted its efforts to make the mill a profitable operation has been unsustainable due to ongoing economic challenges. This mill has a capacity of about 230,000 tons/yr. of specialty, packing, and food service grades

After 98 years, Dunn Paper is closing its Port Huron mill on November 18th. Port Huron is one of its seven locations and the only one closing its doors. They are closing due to struggles generating positive cash flow during these times. Last year, Domtar Corp closed its Port Huron mill after more than 130 years in business. Port Huron produced barrier papers, wax coated, MG, creped tissue, paper with bio-based coatings, label face stock, and release liners.

ND Paper’s Biron Mill will soon convert to recycled containerboard, which result in a reduction of approximately 20% of domestic coated mechanical paper and will extend the inflated prices well into 2023.

Reports are that previously-converted Midwest Paper’s Combined Locks, WI Mill may shift some time back to uncoated freesheet. The demand for uncoated freesheet may give other mills who have converted to containerboard pause to consider alternating between the production of both based on whichever is fiscally attractive at any given time.

Uncoated Freesheet

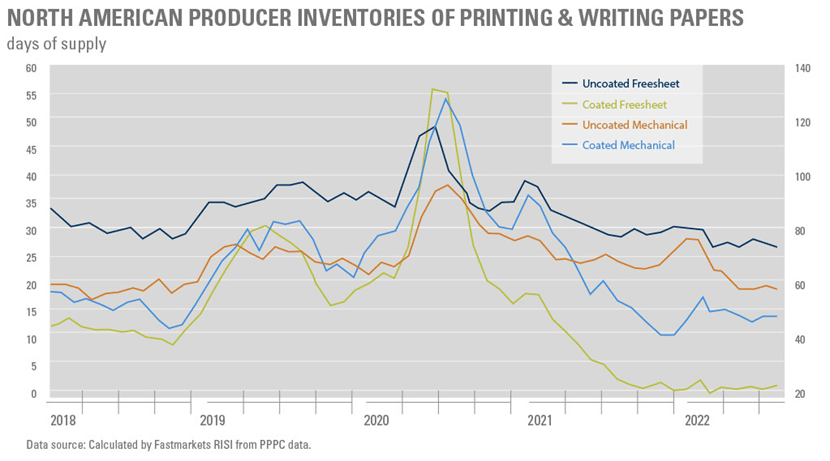

Uncoated freesheet prices were stable in August but rose in September, while uncoated mechanical prices remained steady. This segment continues to benefit from the return of people to schools and offices. The post-pandemic demand recovery and stability have been healthy, and demand has now fully regained its pre-pandemic trend. Operating rates are expected to top 95% in the first part of 2023. Announced capacity reductions are expected to keep operating rates high for several grades through much of the year.

For the most part, mills have been paper in, paper out. Mills have been heavy with sheetfed inventory, making them hesitant to bring in imports. Aside from sheetfed, inventory is mostly at a printer level. Mills and merchants do not have any on hand. The availability of uncoated has seemed to improve over the past months. It is possible we’ll see an unallocated market in Q1/Q2 of 2023.

Coated Freesheet and Mechanical

Coated freesheet shipments decreased 7% below their average of the past five months, falling to their lowest level of the year. September saw an increase in prices of all coated papers, now at 50% above their 2020 levels. Inventories remain at about 25 days of supply at the mills, leaving them to fulfill orders directly from paper machines. This lack of cushion leads to concern.

Imports and Transportation

With the cessation of the Finland UPS paper mill strike, production of graphic paper has resumed and the impacts are being felt in the way of increased imports. Imports from Norway and Sweden have returned to normal levels. Additionally, ocean freight costs have recovered remarkably with the relative changes in some global currencies. It has been forecast that North American demand is being fulfilled by imports to the tune of 11.7%. Coated freesheet shipments dropped significantly in August, while uncoated mechanical imports climbed to their highest level since 2021.

Ground transportation in the contiguous United States has improved with rates dropping an average of 29% in September, although freight costs are still at an inflated rate of 170% higher than pre-pandemic prices. Truck availability remains an issue as well with eight loads available for every driver on average across the US.

Closing Thoughts

We anticipate pricing to stay at current levels into Q1 2023 based on current market signals. SPC will continue to monitor things to help you plan your future print projects. We are here for you in this challenging time. We understand that careful planning ahead on a project and the willingness to be flexible and nimble in exploring options, not just with respect to the type and weight of paper used but also with respect to the design and layout of the project, can enhance the likelihood of obtaining the desired paper in a timely manner.

Contact Ryan LeFebvre at ryanl@specialtyprintcomm.com for assistance in making your DM programs a success.