The Paper Market Unfolded series is published quarterly and summarizes updates and insights from the printing industry over the previous quarter.

The release of this issue was delayed into February to ensure we included the most recent new year announcements. Our goal is to combine a review of the prior quarter with these timely updates in each report.

2026 started with several key suppliers in the uncoated freesheet (UFS) market announcing price increases. This was due to a number of factors, including mill closures and tariff-related removal of inventory/restocking from several large imports. Domestic mills are forecasting a capacity run rate of 91% to 94% going forward.

These developments have collectively led to a flurry of additional price increases:

- On December 18th, Pixelle Specialty Solutions announced a price increase of 6% – 9% for all products, effective January 26th.

- On January 5th, Sylamo announced a price increase of 5% – 8% on converting papers, printing papers, and office papers, effective February 4th.

- On January 6th, Phoenix Paper announced a price increase of 6% – 12%, effective February 6th.

- On January 15th, NORPAC announced a price increase of 5% – 8% effective February 15th.

- On January 15th, Domtar announced a price increase of up to 8% on converting papers, printing & publishing papers, and office papers, effective March 1st.

- On January 16th, ND Paper announced a price increase of 5% – 8%, effective February 16th.

- On January 16th, Sustana announced a price increase of 5% – 8%, effective March 1st.

- On January 20th, Boise Paper announced a price increase of up to 6%, effective March 2nd.

- On January 20th, Finch Paper announced a price increase of 5-9%, effective February 16th.

- On February 3rd, The Navigator Company has announced a price increase of 5-8%, effective March 1st.

Boise and Sylvamo are currently on allocation, which means that the available supply is limited. When mills enter an allocation phase, merchants and printers are only allowed to purchase based on their previous buying history. SPC has proactively pre-bought additional inventory from Boise, anticipating this situation. We expect the allocation period to last only a few months. This is why we emphasize the importance of planning ahead and communicating early with your SPC rep.

But first, let’s look back at Q4 of last year to see how we got to this point.

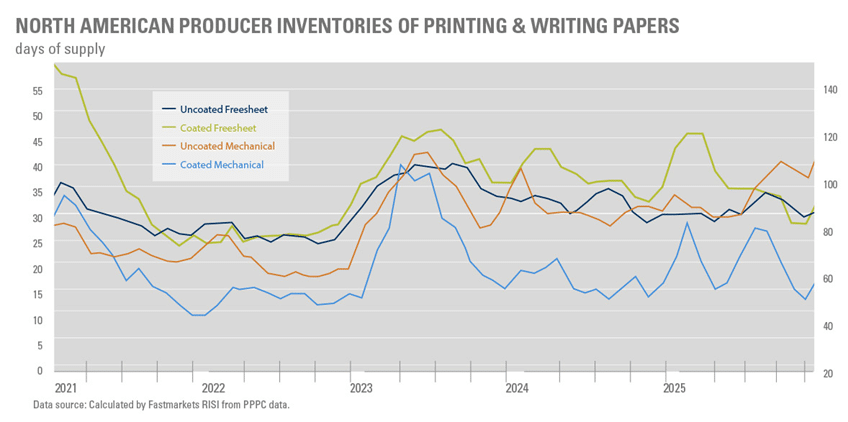

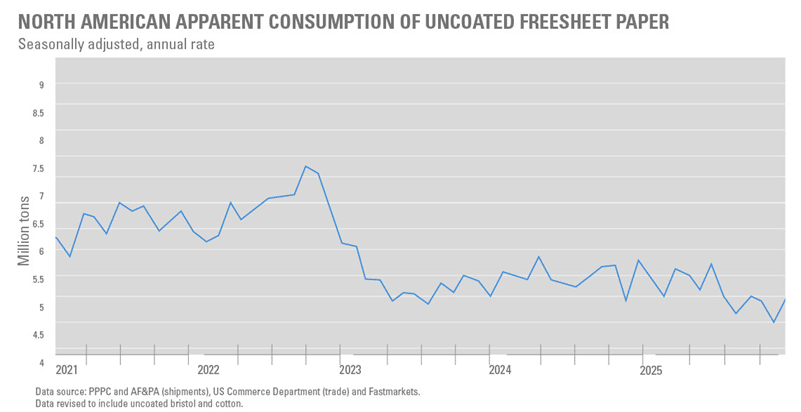

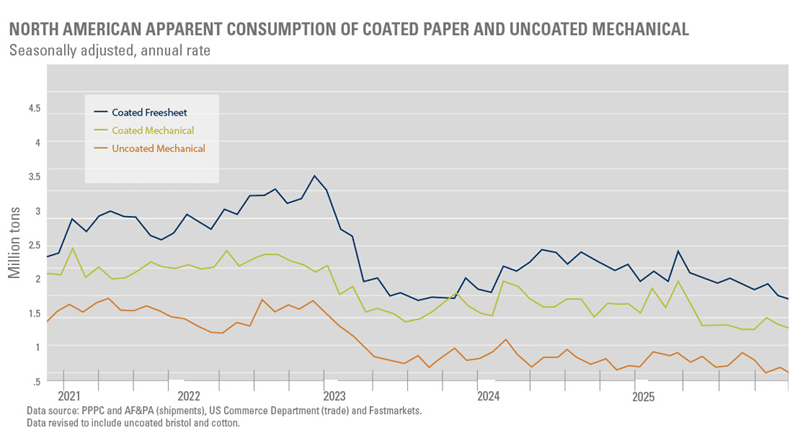

North American P&W demand declined 6.6% in 2025, reversing the 5.8% rebound seen in 2024. Due to tariff deadlines pulling forward imports, shipments performed worse than demand in 2025, falling 8.6%.

P&W shipments trended downward, falling in November to their lowest level of 2025, dropping 12% year-over-year. The weakest performances were for coated freesheet and uncoated freesheet, though some of this may be due to tariff-driven fluctuations in imports and inventories. Tariffs remain a major development as import duties, especially from Europe and Brazil, have pressured offshore supply and reduced imports.

UPM & Sappi Announce Joint Venture

UPM and Sappi announced in early December they were forming a 50/50 Joint Venture focused on graphic papers. This would combine UPM Communication Papers (all business in Europe and the US) with Sappi’s graphic paper business in Europe. This venture would ensure the long-term viability of the European paper industry and strengthen supply security.

In 2026, International Paper (IP) will convert its Riverdale mill in Selma, Alabama, from uncoated freesheet to production of containerboard, operating entirely as a packaging paper facility. We expect this conversion to tighten the market as it will reduce capacity of uncoated freesheet by another 260,000 tons.

Uncoated Freesheet

2025 imports were largely influenced by tariff policy. In August, tariffs on imports from Brazil were raised to 50%. Since then, US offshore imports of uncoated freesheet have dropped, falling from an average of 74,000 tons in the first seven months of 2025 to just 40,000 tons in September and October.

Due to a decrease in capacity and tighter availability, uncoated offset and opaque mills have announced increases of up to 6-9%, depending on the mill.

Average confirmed paper price increases:

- 50# uncoated: 5.54% increase

- 55# uncoated: 5.6% increase

- 60-80# uncoated: 5.67% increase

Average lead time increases:

- Uncoated offset: now 4–6 weeks

- Opaque: now 4–8 weeks, depending on the mill

To support quick-turn orders, there is additional inventory available on select uncoated grades.

The exit of uncoated freesheet from IP’s Riverdale mill, combined with the closure of Pixelle Specialty Solutions’ Chillicothe mill in August, the third-largest producer of uncoated freesheet paper in North America, could result in the market’s operating rates rising to 92% in 2026. Hence, the already announced price increases for 2026 are going into effect as we write this update.

As the market is tightening due to capacity closures, as well as the recent price increases, offshore producers with manageable duties might increase their market share in the U.S.

Coated Freesheet

The coated freesheet market is currently experiencing some tightness, but we anticipate it will stabilize by mid-April.

December coated freesheet shipments were the lowest level since April 2023. RISI anticipates demand recovering enough from the fourth quarter, which is to say it will only fall 6-7% in 2026, for operating rates to average just over 80% in 2026.

At this time, no coated price increases are expected. Delivery of caliper grades in rolls from Sappi have moved to 6-8 weeks out from the date of order. Billerud and ND are good options as alternate mills. Planning ahead can save you even more on text weight coated freesheet options available from overseas mills; assume 12-week LDC’s before press date.

Key Takeaways

The story of 2025 included uncertainty around tariffs, mill closures, continued allocations, and reduced imports, all of which created a tighter market. Currently, the market appears stable and is recovering. We will monitor whether the projected USPS 5% postage increase in July impacts demand in any way.

Planning ahead with your SPC rep to place orders in advance will be more important as market conditions evolve. We will keep you informed on breaking news to help you navigate ongoing changes.