Lower Shipment Volume Signals Softer Market in 2025

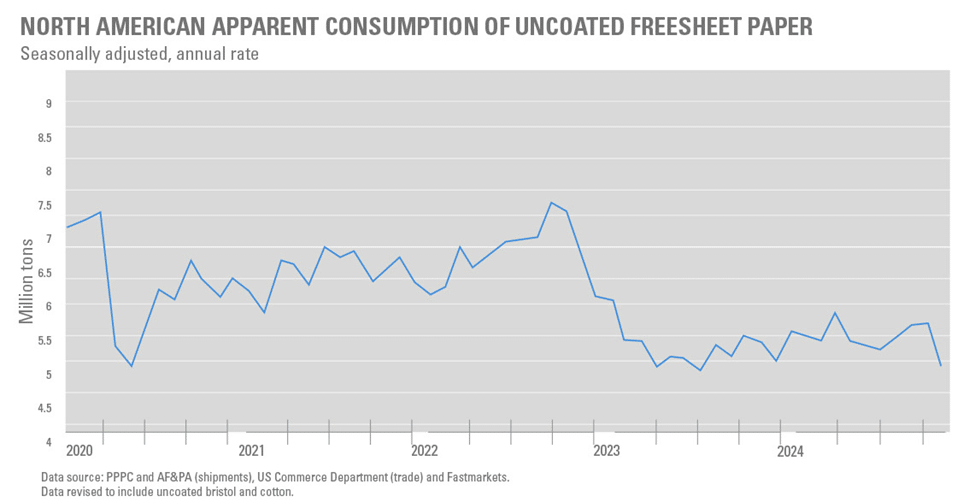

The North American printing and writing shipments decline continued into Q4, hitting its lowest level of 2024 in November, potentially indicating a weaker market in early 2025. Weak performance in the uncoated free sheet market was a key contributor. Overall, the demand recovery and steady performance seen in 2024 remain possible but will be hard-pressed to hold together in 2025.

Labor Resolution at the Ports

International supply is on the road to normalization as a six-year contract agreement was reached between dockworkers at eastern U.S. ports and ocean freight.

Another supply risk: The incoming president’s administration’s new tariffs, of as much as 25% on goods from Canada, will primarily be affecting the coated paper world. European tariffs are up in the air right now and there are mixed indicators for pricing.

Unexpected Price Increase Announced for 2025

In early December, price increases for uncoated freesheet were announced. Now that we are in January, the recently announced price increases for coated paper have taken the market by surprise. Mills are nearly sold out of coated web sheets because companies without quarterly price protection are adding to their inventory or purchasing paper early to beat the announced price increase. Looking ahead to 2025, capacity will be a key factor. If demand for web sheets continues to rise, we may see another price increase in 2025, particularly if more equipment is removed from the market. The market will need to monitor how capacity changes and develops throughout 2025.

Mill Updates

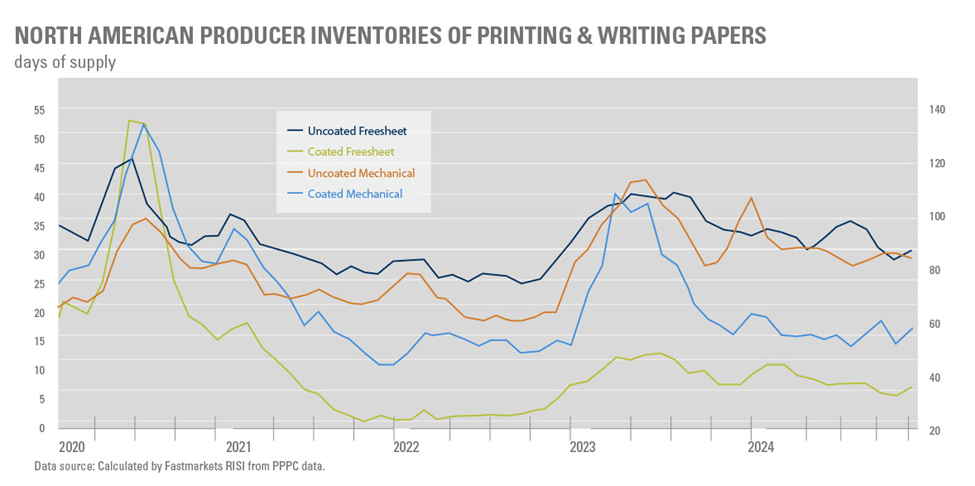

The working understanding that you can secure paper and be on press within 3 – 4 weeks is still more the norm versus the exception. Mills are working to maintain an inventory that aligns with demand. Instead of continuously running and increasing inventory, mills are taking more downtime. This trend is more evident with sheet paper than with web paper.

International Paper’s (IP) Georgetown mill exited the market in December, removing 610 million pounds of uncoated freesheet capacity. We expect the closure of the Georgetown facility to raise the operating rates for uncoated freesheet paper to 92% in the first quarter of 2025.

Sappi’s Somerset will begin the conversion of its coated freesheet machine to packaging in January, removing 480 million pounds of coated freesheet. This conversion is discontinuing lightweight coated – which went as low as 40 lb. text – predominantly used for the catalog and magazine industries. This paper machine will now primarily be focused on the graphic side of the industry, 60 lb. text up through cover weights.

Billerud announced a gradual conversion plan for the Quinnesec and Escanaba mills starting in mid-2025. By 2028, it will reduce coated paper capacity at these mills by roughly 200 million pounds as it shifts production to packaging grades.

Uncoated Freesheet

November proved to be a challenging month for the uncoated freesheet market, as shipments fell to their lowest levels in 2024 following four consecutive months of improvement. This poor performance in November raises concerns that the market may weaken more than anticipated in 2025. Assuming imports will replicate their share of 13% of demand in 2025, we can expect operating rates to hit 92%. The tariff threat to uncoated freesheet coming from Canada is only slight as only 5% of U.S. uncoated freesheet demand comes from our Northern neighbors in the forms of Domtar’s cut size papers and Saint Jerome’s high recycled content papers. Due to the competitive pricing, UPM and Arctic paper are showing interest in importing uncoated freesheet into the U.S. market to compete with Opaques and offsets. A potential downside to this could be extended lead times of around 8 weeks. This approach would be more suitable for programmable work rather than for spot work. SPC is keeping an eye on the possibility that UPM may be looking to increase its share of the U.S. market.

Here is a breakdown of the price increases that took effect in early January. There is some speculation that the prices of uncoated freesheet may not hold up for long. SPC will be closely monitoring the supply and demand of uncoated freesheet, as well as pricing, to see if these market dynamics will affect the sustainability of recent price increases.

- Sylvamo will increase prices by 5 – 7% for converting papers, printing papers and office papers effective with shipments on or after 01/02/2025.

- Finch will increase prices by 5 – 8% for all sizes of Finch printing, converting, publishing, digital/inkjet, technical specialty, and office grades effective 01/09/25.

- Boise Paper will raise prices by up to 7% for private labels and branded office papers, printing papers, and converting papers effective on 01/13/25.

- Domtar will increase prices to $3.00/cwt for office papers, converting and technical papers, and printing publishing papers effective 01/13/25.

- Phoenix will increase prices by 5 – 10% for Phoenix offset, envelope, reply card, MOCR, inkjet, tag, and ledger effective on 01/13/25.

- Sustana will price increases by $3/CWT for all grades effective 01/13/25.

Major importers such as Navigator, Suzano, and UPM have also announced January price increases.

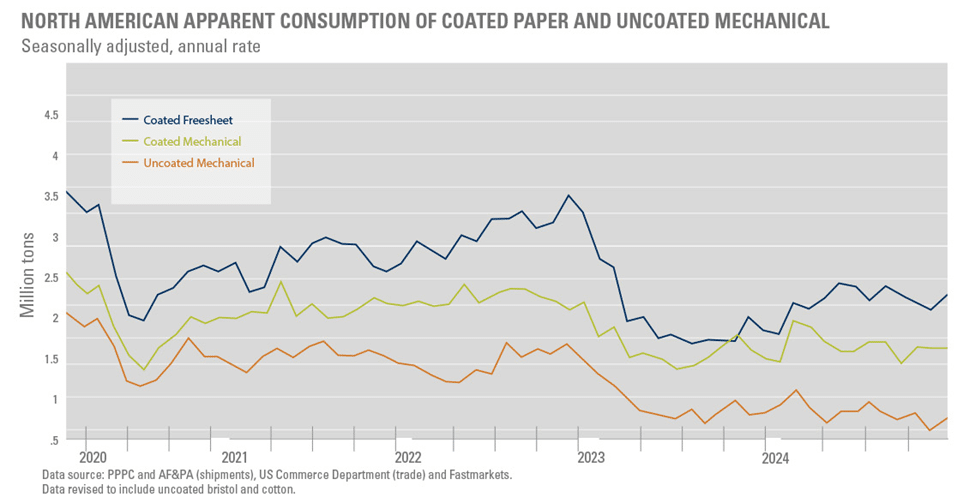

Coated Papers

Coated paper imports were greatly affected by the port strike in October sinking 28% compared to the previous three months. Even with that dip, imports still accounted for a 27% share of the coated paper total demand in October. For comparison, imports had a 36% share in Q2 2024.

The conversion of Sappi’s PM2 at the Somerset mill, effectively removing 480 million pounds of coated freesheet from the market, will allow coated freesheet operating rates to rise to about 87%.

RISI Fastmarket predicts a “faster-than-typical decline for coated freesheet demand in 2025 after the 18% rebound projected for 2024, while coated mechanical demand will need to improve on its performance in the second half of 2024 to fall by less than 4% in 2025.”

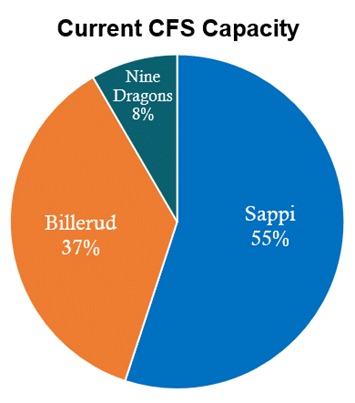

The coated paper industry has followed the lead of the uncoated paper sector by implementing a price increase for 2025. Both Sappi and Billerud announced price increases affecting confirmed delivery dates on or after February 10th. ND Paper (Nine Dragons) recently announced a price increase affecting delivery dates on or after February 14th. These three mills account for nearly the entire domestic market for coated paper. UPM has yet to announce any price increases on coated paper. This also may suggest a potential objective to increase their market share in the U.S.

- Sappi North America announced a 5% price increase on new and unconfirmed web orders for the following paper products: McCoy Web, Opus Web, Somerset Web, Flo Web, and Galerie Web.

- Billerud announced a price increase of as much as 5% on the following coated freesheet web grades: ArborWeb Plus, Sterling Ultra, Sterling Ultra EX, Sterling Points EX, Sterling Ultra Caliper, ArborWeb, Influence, and Influence EX.

- ND Paper (Nine Dragons) announced a price increase of 5% to all basis weights, finishes and grade extensions effective 2/14/25.

Conclusion

The stability we anticipated for the remainder of 2024, came with some warning bells for 2025. The decline in North American printing and writing shipments, particularly in uncoated freesheet, signals potential challenges for early 2025. Additionally, mills are choosing not to build inventory, reflecting ongoing market uncertainties. Price increases have already been announced for paper grades, from printing, converting, publishing, digital/inkjet, technical specialty, and office grades in uncoated freesheet to coated freesheet web grades.

Our advice remains the same: communicate with your SPC Representative to plan the best paper options that meet your timing needs while minimizing costs. SPC will keep you informed and help you navigate the evolving landscape of the paper industry.