2022-A Year of Uncertainty

Uncertain is an appropriate word to describe Q1 2022. Although the pandemic appears to be winding down, the effects of it continue to be felt throughout the entire global economy. In the print and direct mail industry, marketers are feeling the challenges on a daily basis, particularly in the paper market, where demand far outweighs supply and the paper supply chain is very unbalanced.

The conflict in Ukraine, which no one anticipated until it was in full flourish, has created cascading effects on supply chains, affecting higher line-haul trucking rates and other transportation costs due to rising oil prices. Currently, international paper shipments are often sitting offshore or on docks on both coasts, waiting to be unloaded. It is difficult to know when these challenges will subside but we DO NOT believe it will happen in 2022.

In our Q4 2021 Paper Market Unfolded, we discussed three ways the supply and demand curve can be altered:

1. Significant increase in domestic supply

2. Significant increase in international paper shipped to the U.S. market

3. Significant decrease in demand for print

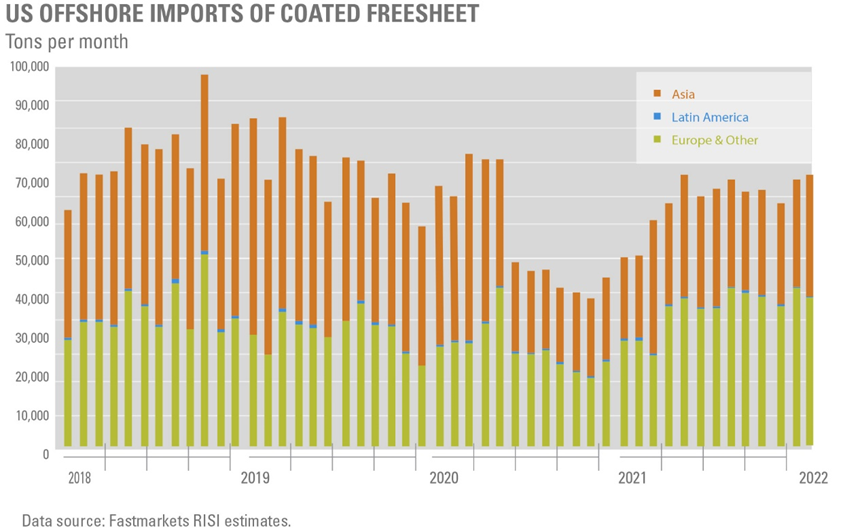

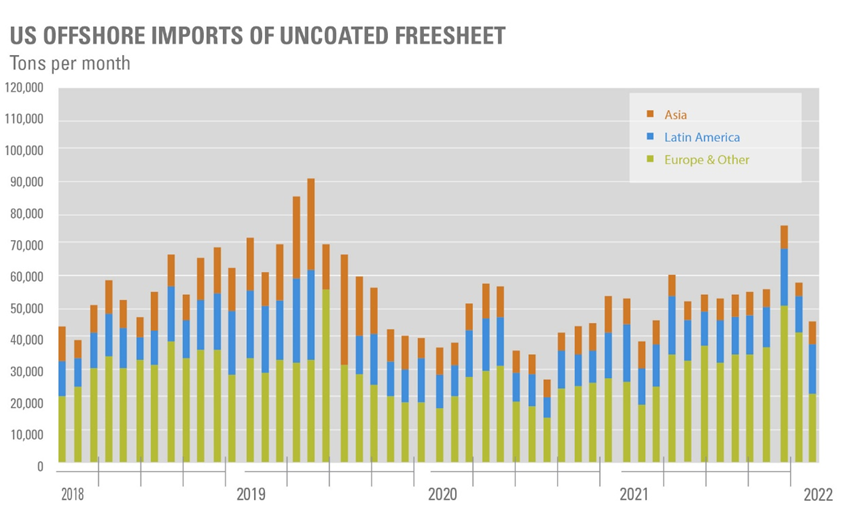

At the end of Q1 2022 little has changed. Print demand is still high. Domestic paper production remains stretched thin. We believe an increase in international supply remains the best way for the market to find balance again and we hope and expect to see this starting in early 2023. Until then, we anticipate continued industry upheaval. Despite the unprecedented challenges that remain ahead, SPC and our clients have worked diligently together to find workable and often creative solutions to still accomplish their marketing goals. SPC is determined to not let these challenges diminish the effectiveness of direct mail and other paper-based communications.

Upcoming Price Increases

When Nine Dragons (ND) announced a price increase in January, Verso and Sappi soon followed with increases as high as 8% on existing and new orders. The increase applies to all basis weights, bulks, finishes, and related private label grades. In addition, the supply of fiber for making marketing paper has been tight, forcing ND to halt offering PCW as of 3/23/22.

Additional Recent Major Pricing Announcements:

- 04/01/2022 – ND added a $4/cwt USD ($5/cwt CAD) surcharge for all Orion, Oxford, Glide, Escanaba, Consoweb, and Rumford Offset products. ND’s Escanaba grade line will be discontinued, but existing orders manufacturing prior to April 20th will be honored.

- 05/01/2022 – Finch’s pricing will increase 6-10% USD for all grades: Finch Printing, Converting, Publishing, Digital/Inkjet, Technical Specialty, and Office papers.

- 05/02/2022 – Boise Paper will increase prices up to 10% on private label and branded office papers, printing papers, and converting papers.

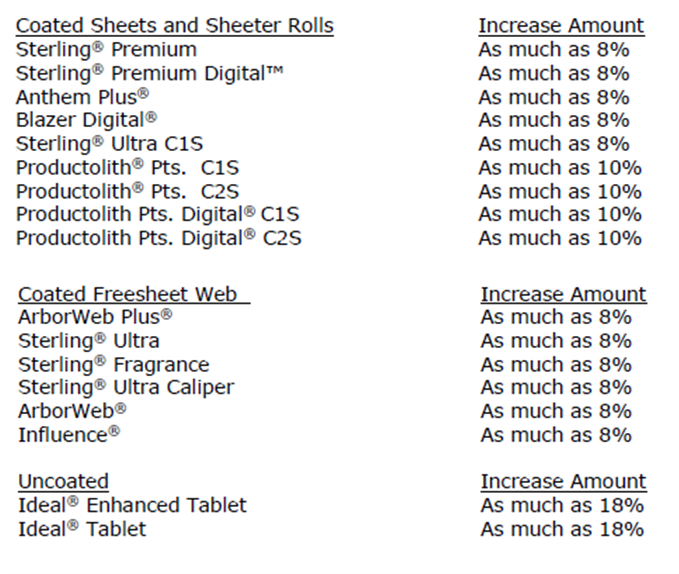

- 05/02/2022 – Verso is increasing a transactional price of the following Coated sheets and Sheeter rolls, Coated Groundwood Web, Coated Freesheet Web, and Uncoated grades, including but not limited to:

- 05/16/2022 – Sappi announced a transactional and list price increase of up to 8% on Graphics Web and up to 15% on Graphics Sheets on new or unconfirmed orders booked with a delivery date on or after May 16th. Products affected include common direct mail papers: McCoy, Opus, Somerset, and Flo.

- 05/16/2022 – Sappi narrow roll upcharge will be increased to $8/cwt on roll sizes less than 23”.

Its important to note most paper mills are setting prices at the time of shipment, NOT when the order is placed. This means any existing orders still could face price increases.

The sheetfed market will continue to be stressed through 2022. Since 60% of sheetfed sheets have traditionally been imported, the extreme global logistics issues have made sourcing these products difficult. To make matters worse, the UPM mill in Finland has seen production grind to a halt as a prolonged strike continues. This specific UPM mill produces a variety of basis weights that include coated sheets such as 60 and 70# text.

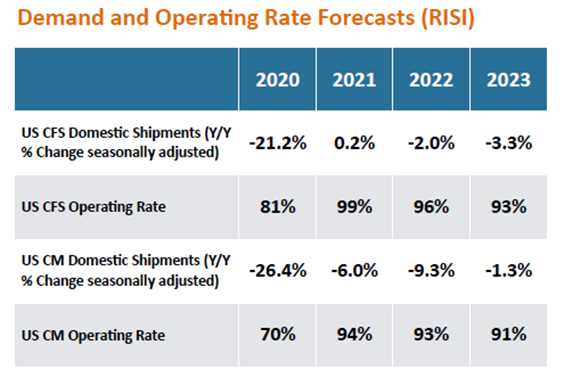

Domestic Inventories, Demand and Operating Rate Forecasts

Global Imports See Fallout from Russia-Ukraine Conflict

Russia currently supplies about 30% of Europe’s oil and 35% of its natural gas, which could be cut off as a result of the conflict. This would push already-elevated prices of oil to upwards of $125 USD per barrel. With transportation and logistics already strained by current fuel prices and the lack of truck drivers, this rise in fuel prices could exacerbate an already challenging situation. Additionally, as a result of inflation increases, the cost of transportation has seen ongoing increases coupled with a shortage of shipping containers.

BillerudKorsnäs Completes Merger with Verso Corporation

On March 31st, an announcement was released that BillerudKorsnäs and Verso completed their merger. The new company will go under the shortened name of Billerud, with its headquarters in Miamisburg, Ohio. The plan is to convert two of the former Verso’s existing manufacturing assets located in Escanaba, Michigan to paperboard production by 2029. They hope to create the industry’s most cost-efficient and sustainable production platform. There are no changes in the short-term for customers. There are believed to be no plans to restart the Wisconsin Rapids mill and there is thought they may try to sell the assets.

ND to Begin Converting Marketing Paper Production to Packaging

ND has announced that the Biron mill will be converting its second coated mechanical paper machine to production of packaging papers at the end of 2022, further constraining an already tight market. This line currently produces lightweight coated grounded which is used to manufacture items such as catalogs and magazines.

Rumors are swirling that the Phoenix mill in Wickliffe, KY may also be converting from offset to packaging paper.

Keep an Eye on Supply Leading up to Mid-term Elections

The mid-term election season may cause additional pressure on supply. Any individual candidate campaign mailing won’t take priority in the paper market, but it is possible the US Government could impost eminent domain to acquire paper, if needed, for ballots and broader election processes. If this were to happen, it would likely be only on uncoated paper.

Paper Mill Scheduled Maintenance to Reduce Supply in Q3

Multiple mills have traditionally scheduled machine downtime for maintenance and repair in the summertime. Mills have planned a slight decrease in monthly allocations to allow for a small inventory to be built and used while machine downtime is in effect.

Final Thoughts

Plan well ahead. An order placed at the end of April would be placed against July allocation and have a mid-July to mid-August date, if there is capacity to be used out of that allocation.

Inquire with your SPC rep about an opportunity to secure sheetfed paper if you are able to plan four months in advance with a large and ongoing program. We’ve helped multiple clients secure a long-term paper supply.

Note: Text weight stocks 60 – 100# are currently not as hard to acquire than caliper and cover grade stocks.

Prepare for Paper Delays. Paper delivery has historically been reliable and on time. In the current climate, we have seen paper delivering late at an increasingly high rate, ranging from one to two days to over a week in some cases. SPC will always do everything we can to help navigate when these challenges arise.

Interested in Touring a Paper Mill? Join SPC as we partner with Billerud to host a paper mill tour and woodland harvesting tour in September. All interested parties can email Ryan LeFebvre to learn more and sign up.

Thank you to the more than 130 client partners who joined SPC on our March Paper Market Roundtable Zoom discussion with Sappi and Midland. Craig Busby from Midland emphasized the importance of planning ahead. In order to budget properly in these hard times, Mike Hall from Sappi suggested spreading out your orders into smaller volume requirements and building towards your bigger paper jobs. Committing large orders five or six months in advance will allow SPC to give you the best chance at securing paper. Keep an eye out for our next roundtable in the near future.

SPC is here for you in this challenging market. At SPC, we understand that careful planning and the willingness to be flexible and nimble are critical right now.

Contact Ryan LeFebvre at ryanl@specialtyprintcomm.com for assistance in making your DM programs a success.