At SPC we’re always trying to keep you up-to-date with the latest info and intelligence that relates to your marketing efforts. In recent months, it has become clear that changes in the paper market will affect both pricing and project timelines.

Increases are Coming

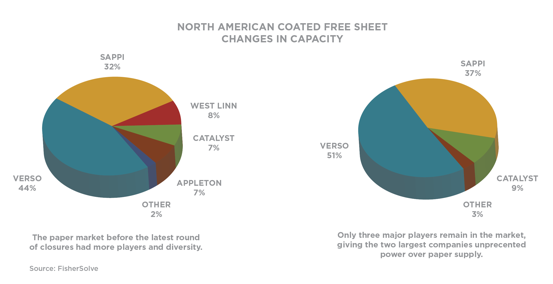

As an echo of our earlier post, we are expecting additional increases on coated paper stocks. We anticipate a price increase near the end of Q1 or early Q2, and potentially another bump by the end of 2018. These upward movements we’re seeing are not being driven by an increase in demand, which is typically the case, but by a reduction in supply, and the difference is important. Direct marketing that utilizes print and packaging is on an upward trend, while nearly all other sectors are down, which is good news. But paper supply is becoming more complicated.

In Short Supply

Multiple factors are contributing to a substantial reduction in paper supply:

The first is the recent closing of West Linn Paper Company’s mill, which shuttered after 128 years. The maker of Sonoma, Capistrano, and C1S Litho Label was a key supplier to West Coast printers and a major purchaser of paper pulp. West Linn faced sudden demise when one of its major pulp suppliers ceased production due to a catastrophic equipment failure and ensuing fire that caused West Linn to cease production. It wasn’t economically viable for West Linn to purchase pulp from another supplier at higher prices, so the company shut down its machinery for good.

Second, Wisconsin-based Appleton Coated closed its plant after the company was sold in October of 2017. The company was the number three player in the Midwest and maker of Utopia One (U1) and Utopia Two (U2) brands, C1S Litho, and other environmentally-friendly stocks. All of Appleton’s production output halted immediately, stopping the flow of paper from this substantial supplier. Their production lines have been purchased by a liquidation company and the fate of that machinery currently remains uncertain.

Third, as a result of increases in paper pulp prices, Flambeau River Papers (FRP), a major supplier of uncoated paper, is shutting down one of its three machines. In addition to manufacturing its own pulp, FRP had previously purchased pulp from outside suppliers, but this is no longer financially feasible. This undoubtedly will result in a reduction of paper supply in the uncoated market.

Fourth, Sappi Fine Paper, another major paper company, is shutting down one of its largest machines for a rebuild, with the stated goal of improving quality and productivity. This work has delayed availability of certain caliper grades for 45 days.

Keep On Truckin’

National transportation issues are also affecting paper delivery times and pricing. For decades, freight drivers have used handwritten logs to document their miles and driving time, sometimes in an effort to skirt Department of Transportation limits on hours of consecutive service.

Effective December 18, 2017, drivers are now federally mandated to use electronic logging devices to record this data, which will not allow for manual adjustments to driving miles and hours.

These requirements aim to increase safety, but will have the unintended consequence of reducing overall delivery capacity in the market, because drivers actually will have to abide by the mandated downtime requirements or risk consequences.

This already has led to a reduction in hours and miles driven, and ultimately it will translate to increased pricing. At this very moment, there are nearly eight loads waiting for every one truck available in many of the largest cities in the Midwest.

Key Takeaways

- We anticipate price increases, but believe that with planning and creative production problem-solving, we can help execute your campaigns in budget-sensitive ways.

- Paper supply will be available for our clients’ needs, but longer lead times might be necessary for some projects.

- SPC is continuing to work with our suppliers and other parties to mitigate any issues, and we believe that ongoing communication is the best way to stay ahead of the issues that affect our industry.

- As always, we’re here to help you find the right solutions for your marketing efforts, partnering to ensure your marketing dollars work their hardest in an evolving marketplace.

Ryan LeFebvre

Executive Vice President of Sales