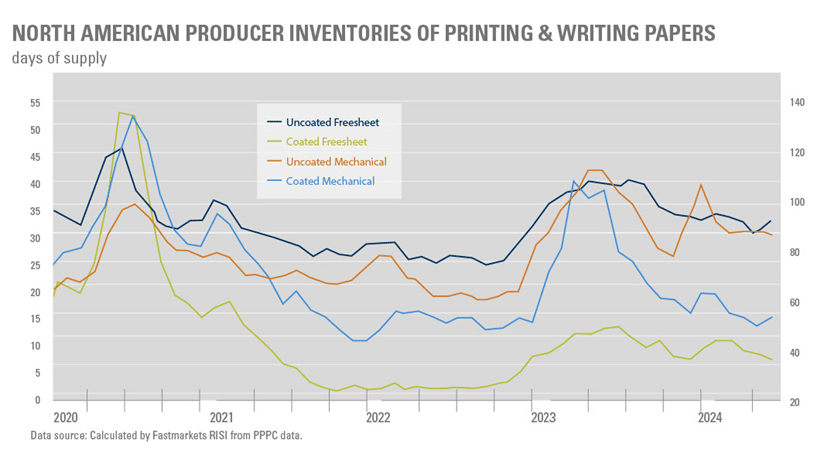

Demand Continues to Fluctuate While Prices Remain Steady

In April, there was a 10% increase in North American printing and writing (P&W) demand, with shipments reaching their highest level since January 2023. However, in May demand reversed course decreasing by almost 7%. The year-over-year gain dropped from 16% in April to 9% in May. Despite these fluctuations, it is still anticipated that demand will increase by 6% over the course of this year.

Import pressures remain high

Thirty percent of P&W demand growth is anticipated from imports this year. As a result, imports are forecasted to jump to 16.6% of the total demand in 2024.

Recently, Mexico implemented tariffs ranging from 15-35% on various paper and board products. However, shipments from the US and Canada are exempt under the United-States-Mexico-Canada Agreement (USMCA), which may give US producers a competitive edge in exporting to Mexico and help counter pressure from imported goods in the US. The market finds itself in a 300 billion trade deficit. 15%-20% of the demand in North America is sourced overseas. A change in political leadership could lead to a more challenging global sourcing environment.

Given the current exchange rates, overseas companies are finding sales of paper in the US advantageous. They are aiming to be competitive with their pricing. For clients with well-planned print or direct mail projects requiring more than a truckload of paper, and can accommodate 8-12-week lead times, there is potential for cost savings.

Postage rates increased in July

The anticipated postage increases began on July 14th. With marketers’ budgets being affected, we anticipate negative pressure in the P&W market.

Pricing remains steady while production fluctuates

Paper prices remained steady in June. We are looking for price stability for the remainder of 2024, even with inflation negatively impacting the economy. Pulp prices have increased 40% over this period last year. With the pressure on the paper industry, we don’t think changes in pulp prices will affect paper prices in the short term.

We anticipate that there will be a significant decrease in the production capacity of graphic paper in the 2024-25 timeframe. However, paper producers seem to be waiting to make final decisions until they can see a strong recovery in demand after losses in 2023. Their final decisions could be influenced if demand rebounds more than expected this year.

Mill Updates

As mentioned in our Q1 Paper Market Unfolded, Domtar’s Ashdown Mill exited uncoated freesheet production at the end of June. This move reduces Domtar’s annual UFS capacity by about 200,000 tons.

Sappi’s Somerset Mill’s PM2 will exit coated freesheet production in January 2025 and convert to boxboard grades. The PM2 conversion will involve halting production of up to 240,000 tons of CWF. Somerset still has a third machine that remains fully committed to coated freesheet.

Billerud has decided to cancel its plan to convert the Escanaba, Michigan mill to boxboard grades. Instead, it will focus on shifting its North American product mix towards packaging materials and contributing to graphic paper production, especially coated freesheet paper.

UPM Communications Papers plans to permanently close its Hürth newsprint mill and shut down one fine paper machine (PM 3) at its Nordland Paper facility in Dörpen, Germany. These closures would reduce UPM’s annual capacity by 330,000 tons of newsprint and 280,000 tons of uncoated fine paper.

Sappi sells Lanaken paper mill in Belgium to private company UTB Waalwijk for €50M; mill closure and sale signal the company’s shift to reduce graphic paper production capacity in Europe, focusing instead on expanding packaging and specialty papers

ND Paper’s Rumford Mill has idled PM12, approximately reducing its P&W and packaging capacity by 105,000 tons. The company is limiting further growth on uncoated in favor of the coated business unless conditions require bringing the machine back online.

Finnish paper workers end historic UPM strike

UPM workers returned to work on April 23rd, ending a 112-day strike. The new labor agreement will last two years with wage increases set to take effect on July 1st.

McKinley Paper announced they are exiting the offset and white bag markets. This is an indicator that brown kraft packaging is picking up and hopefully the rest of the economy.

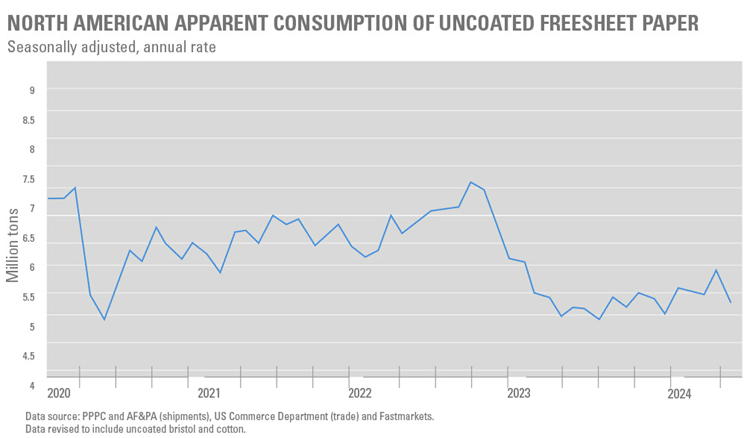

Uncoated Freesheet

The uncoated freesheet market had another positive quarter with seasonally-adjusted demand and shipments in April hitting their highest level since January 2023. We see a strong demand rebound in this market with a growth of 4.2% to date. The potential for more capacity reductions or higher exports may pose a speed bump in the future.

Operating rates for uncoated freesheet were relatively low in Q2 with the occurrence of a large amount of maintenance downtime. June’s operating rates were at 80%. We expect operating rates to average 90.9% in the second half of 2024 and 90.1% in 2025.

Coated Papers

Coated papers eased in May, but overall demand has improved. Shipments of coated freesheet were 14% above May 2023 levels. It is also estimated that demand for coated freesheet is up 10% year-to-date. There is a slight concern in this market as a result of the postal rate increases that took effect this month. This sequence of events could lead to a decrease in mailed advertising or lighter-weight formats and contribute to a resurgence of declining demand. June’s operating rate was 67% for coated freesheet.

If the demand for coated paper rebounds significantly or if domestic mills capture a substantial portion of the market from imports, we anticipate that closures may be necessary. The industry is expected to have an additional 160,000 tons of unannounced capacity reductions each for coated freesheet and coated mechanicals by 2025.

Closing Thoughts

While there has been a recovery in demand, with some monthly fluctuations, the industry is still expected to see a 6% increase in demand for the year. Import pressures remain high, and there is uncertainty around the impact of postage rate increases and potential capacity reductions. The industry is anticipating stability in prices for the rest of 2024. Overall, the paper market is navigating through a period of change and remains resilient in the face of various challenges. SPC will keep you informed, helping you navigate the evolving landscape of the paper industry.